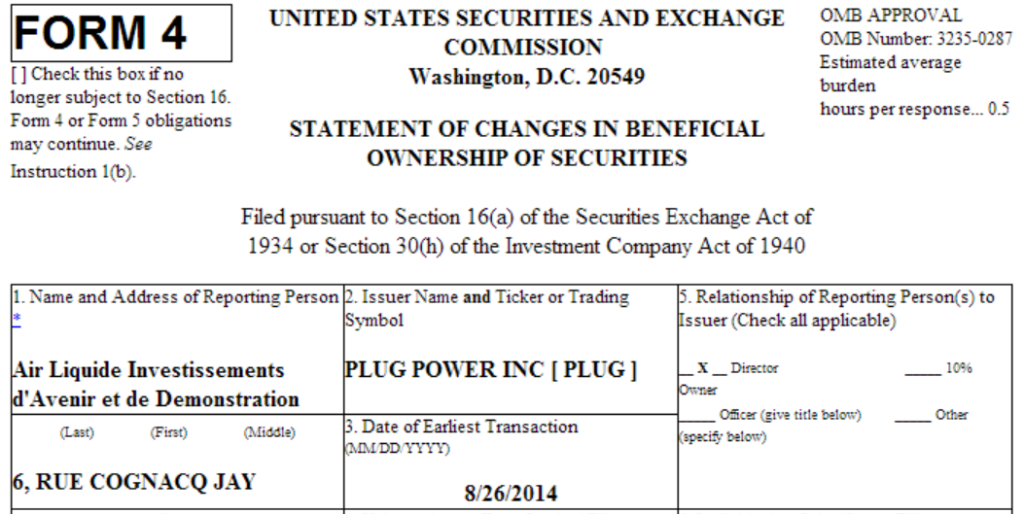

Back on June 13, Plug Power chairman George C. McNamee transferred 365,000 of his company shares (nearly 60% of his total ownership) into a trust account that will likely benefit his family years from now. Then on August 26, Air Liquide cashed-in and sold half of their preferred shares, leaving the French gas supplier with just over 50% of their initial position in Plug Power.

With people worrying about the Air Liquide sale, I thought I’d take a minute to look at this through the eyes of a real-world investor:

If you made an investment that saw ten-fold returns, you would likely start looking into ways to maximize your new cash pile. You would re-think your initial investment and weigh your options. You’d take one of three routes regarding that initial investment:

- Keep all your shares – You’d likely take this route only if you anticipated probable and extraordinary near-term gains

- Sell all your shares – You’d take this route if you lost all faith in the company

- Keep some, sell some – You’d take this third route if you had faith in the current company’s long-term future but saw other good investments waiting around the corner

Air Liquide took the third route. A good investor always looks for ways to diversify their cash. It’s both smart and exciting to find other opportunities out there. Yes, Air Liquide has inside knowledge of the company, and yes, this likely means that they don’t anticipate tenfold gains for Plug tomorrow morning. But Air Liquide knows Plug Power is growing exponentially, and they have more than enough shares to benefit handsomely as Plug continues that growth.

As for McNamee, another person with inside knowledge of the company. . . he transferred more than half his shares into a trust account. Maybe he started working on his will, maybe he wants to pay for his grandkids’ college tuition, or maybe he just wanted to avoid taxes. However you look at it, he could have easily sold all those shares. Putting them into a trust account, though, shows that he believes in Plug Power’s long-term viability.

As a long-term Plug Power investor, I realize that I’d be irresponsible to blind myself to other opportunities out there. Like Air Liquide, I will always expand my portfolio as I see fit. That being said, Plug Power still has the potential to be absolutely gigantic someday, so unless my thesis gets proven wrong, I will always keep most of my initial investment in the company.

For all the swing and day traders out there, I have no clue how things will turn out for Plug on a day-to-day basis. For the long-term investors, though, there seems to be a good consensus regarding the benefits of a multi-year (even decade) Plug Power investment.